Rising motion of house owners insurance coverage danger to the U.S. surplus strains market has continued to contribute to development for nonadmitted insurers.

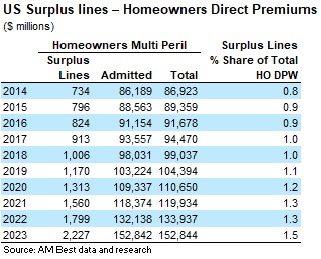

In keeping with a report from AM Greatest, surplus householders direct premiums written in 2023 eclipsed $2 billion for the primary time to extend its share of the overall property/casualty householders DPW to 1.5%—the best share in a decade as volatility in underwriting outcomes for admitted carriers has resulted in elevated charges for property insurance coverage.

U.S. admitted carriers are turning away from property strains, which have seen increased loss exercise, increased reinsurance prices, and retentions of danger, that are all driving premium {dollars} into the E&S section. When the business ranking company aggregates 2024 surplus strains information, AM Greatest stated it expects the pattern of development will proceed. Actually, the U.S. has been a notable contributor to the topline of many London market firms.

The particular report, “Difficult Market Circumstances Yield Alternatives for Surplus Strains Insurers,” launched April 22, stated nonadmitted insurers “have had the flexibleness to satisfy demand throughout powerful market occasions,” resulting in a rise in U.S. householders surplus premiums to $2.2 billion in 2023 from $1 billion in 2018.

The particular report, “Difficult Market Circumstances Yield Alternatives for Surplus Strains Insurers,” launched April 22, stated nonadmitted insurers “have had the flexibleness to satisfy demand throughout powerful market occasions,” resulting in a rise in U.S. householders surplus premiums to $2.2 billion in 2023 from $1 billion in 2018.

The direct premiums written in residential, householders and different private property grew 41% from 2022 to 2024 to make up 4.9% of the overall U.S. surplus strains market.

Total, legal responsibility (together with basic, aviation, and merchandise) and business property made up 36.9% and 32.9% of surplus strains premiums, respectively, in keeping with information from the 15 U.S. surplus stamping places of work nationwide. From 2022-2024, premiums from these stamping places of work elevated 28.8% to about $81.6 billion.

California, Florida, Texas, and New York produced greater than 75% of the overall U.S. surplus DPW in 2024.

The ranking company singled out California, whose private and business property insurers have handled unfavorable outcomes even earlier than this 12 months’s wildfires. Some admitted insurers adjusted their books of enterprise and pushed extra premium to the excess strains market.

“The California property market is prone to face extra challenges within the close to time period, and surplus strains’ insurers may look to fill provide gaps as extra admitted insurers change into reluctant to supply market capability in areas of the state,” stated David Blades, affiliate director at AM Greatest.

Subjects

USA

Extra Surplus

Householders

Excited by Extra Surplus?

Get automated alerts for this subject.