All through historical past, insurers have been pivotal in driving social change, enabling human progress, innovation, and prosperity. From seatbelts to vaccines and fire-retardant supplies, insurers have fostered quite a few improvements. These days, they face a brand new monumental problem: local weather change. 2024 has been one other report loss 12 months for insurers pushed by pure catastrophes linked to local weather change. Insurers are therefore in search of greener pastures. If carried out proper, aiding companies of their transformation to cut back greenhouse fuel emissions turns into a optimistic for insurers. They are often facilitators of the transition to a carbon-neutral future by exerting affect throughout the wide range of industries they finance.

There is a chance for insurers to safeguard their top-line and bottom-line whereas supporting clients on their web zero journeys. In Underwriting, that minimizes threat publicity and scope for regulatory fines by proactively responding to modifications, and shoppers who successfully embark on the inexperienced transition are anticipated to convey greater gross sales within the mid to long run. In Investments, the case is even higher understood: 93% of buyers say that local weather points are most probably to have an effect on the efficiency of investments over the following two to 5 years. Non-transitioning corporations or those that begin transitioning too late are in peril of dropping an funding grade credit standing, whereas the outperformers – what we name ‘inexperienced stars’ are anticipated to profit from inexperienced applied sciences shift in a Paris-agreement-aligned world situation.

A brand new instrument for worthwhile portfolio decarbonization

Insurers want to have the ability to translate their investee and shoppers’ emission discount measures into monetary implications for acceptable threat calculations, to decarbonize profitably on their very own finish.

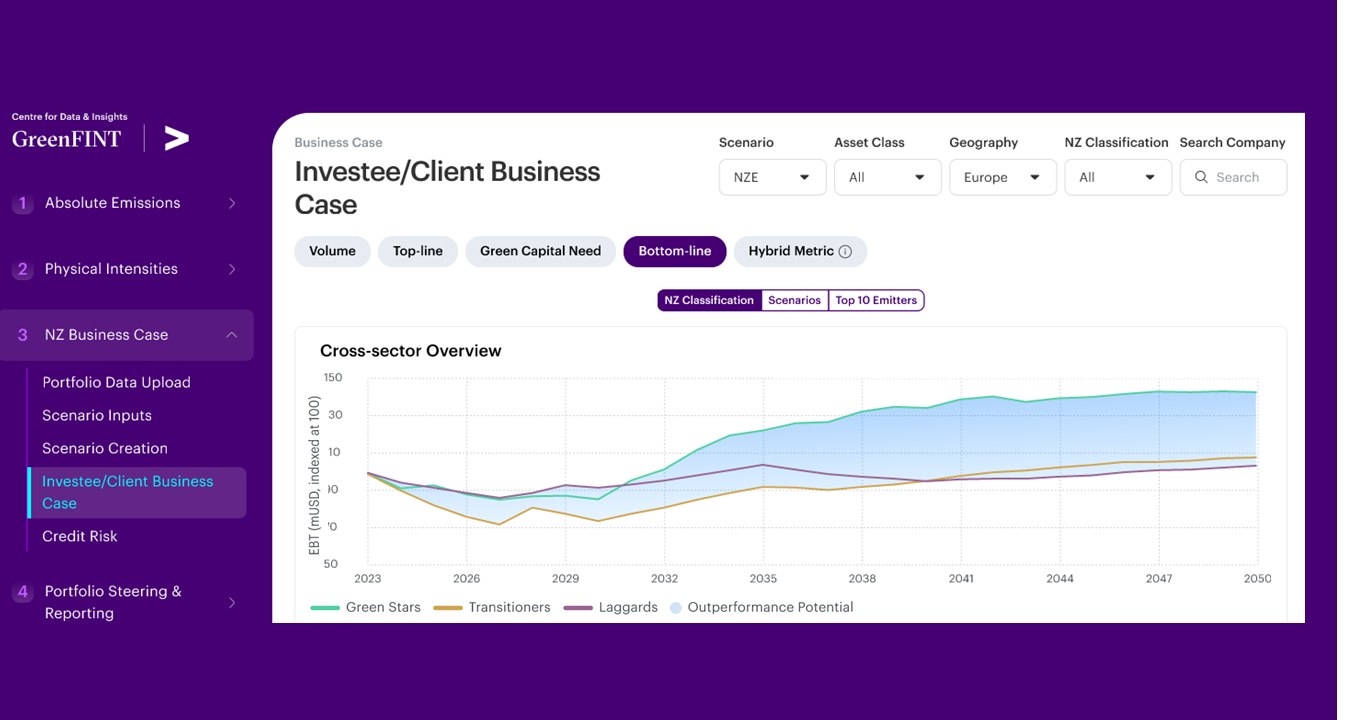

As we at Accenture are dedicated to fostering web zero enterprise practices we have now launched the GreenFInT (Inexperienced Monetary Establishment Software ), also referred to as the Worthwhile Portfolio Decarbonization Software. Evaluating pattern shopper portfolio dynamics up till 2050 for top carbon intensive sectors, it exhibits ‘inexperienced stars’ may outperform ‘local weather laggards’ by 30-40 share factors. The true worth of the instrument lies in familiarizing insurance coverage managers throughout funding, threat and pricing with setting assumptions for various world views, from a ‘sizzling world’ situation to reaching the Paris alignment.

Enable me to delve into the instrument in higher element. The GreenFInT instrument caters to each the emissions measurement and reporting use instances (e.g., ESRS E1 quantitative KPIs for CSRD) in addition to to enterprise worth instances almost about decarbonization. The instrument applies local weather situations (e.g., 1.5°C, 2.4°C) to portfolio corporations’ know-how combine, relying on their Web Zero pledges and transition plans. Variations in know-how combine, pledges, and plans translate into divergent profitability curves by way of required capital investments and variations in operational prices.

‘Inexperienced stars’ win out in the long run

For illustration, an insurer’s ‘inexperienced star’ shopper from the ability era sector with a SBTi verified Web Zero goal by 2040 has and can have a bigger share in renewables than a shopper categorized as ‘laggard’. With its proactive transition in direction of web zero, the ‘inexperienced star’ shopper has preliminary excessive capital prices to finance the construct out of put in capacities from renewable vitality sources to satisfy its milestones whereas electrical energy costs are comparatively excessive – outlining a enterprise alternative for insurers because the shopper is in want of financing and insuring of the renewables constructed out. As compared, a ‘laggard’ firm had no and won’t have capital investments past normal substitute and upkeep prices of its energy vegetation. Alternatively, renewables have a lot decrease operational value in comparison with energy generated from nuclear vitality and pure fuel. Thus, the ‘inexperienced star’ that has invested in renewables in a well timed trend will profit from decrease operational prices whereas the ‘laggard’ can have greater operational prices from conventional vitality sources.

Let’s take an exemplary insurance coverage portfolio with 40 giant firm shoppers from 4 high-intensity sectors, particularly energy era, metal, actual property, and automotive, targeted inside Europe. In a 1.5°C situation, the capital want for the online zero transition of those corporations quantities to roughly 650bn USD 2023-2050 – in line with the GreenFInT modelling. Whereas within the mid-term up till 2030, the EBT margin of ‘laggards’ outperform ‘inexperienced stars’ by roughly 6 share factors, within the long-term, 2023-2050, ‘inexperienced stars’ outperform ‘laggards’ by 30-40 share factors (see graph beneath).

This forward-looking strategy – leveraging scientific sector carbon budgets vs. conventional forecasts primarily based on historic values – permits insurers to combine long-term situations (as much as 2050) into their present concerns. It is a most essential step in direction of breaking the ‘tragedy of the horizon’. GreenFInT makes it potential to establish insurers’ investees and shoppers with reliable web zero commitments because the enterprise case evaluation can reveal who might not be capable of afford their web zero commitments. Constructing a trusted relationship with these corporations as insurer or investor at this time, is vital for a worthwhile decarbonization. Insights gained by way of GreenFInT may be useful to prioritize shoppers to interact with and a grounded dialog opener to raised perceive the shoppers’ transition plans.

Past a web zero enterprise case evaluation, GreenFInT additionally covers the accounting of Scope 3 Class 15 emissions in absolute phrases and bodily intensities in addition to goal setting and a ‘What-If’ functionality, enabling insurers to simulate results on their carbon footprint with changes to their portfolio.

The time to behave is now

Insurance coverage has constantly demonstrated resilience within the face of quite a few challenges, and the present push in direction of decarbonization isn’t any totally different. By embracing the transition to web zero, insurers cannot solely safeguard their profitability but in addition play a pivotal function in fostering a sustainable future. The mixing of science-based sustainability targets into underwriting and funding practices will allow insurers to drive important change throughout numerous industries. As regulatory pressures and public expectations proceed to rise, insurers should act decisively to keep away from the dangers of inaction and greenwashing. The instruments and methods outlined present a transparent pathway for insurers to realize worthwhile portfolio decarbonization, guaranteeing long-term progress and belief in a quickly evolving panorama. The time to behave is now, and the alternatives for many who lead the cost are immense. For additional dialogue on the right way to implement these methods in your enterprise, please get in contact.